Average 2.5 Days Waiting For A Truck Return Load In Turkey

Tırport, Turkey’s largest digital logistics platform, has digitized the logistics industry end-to-end and has become one of the few logistics technologies in Europe with its digital assets and business volume. The Turkish logistics industry, which enters 202 with hope, has the potential to reach 1 trillion dollars in the next 10 years if it provides end-to-end digital transformation and is supported with the right investments.

Road transport in the logistics sector continues its global leadership. Highways are still the dominant sector in the global transfer of products from one point to another. In the world average, 70% of freight transport is done by highways. While the European Union average is around 75 percent, this rate is 70 percent in the USA and 60 percent in the UK. In Turkey, 90 percent of the transportation is done by highways.

Stating that they have become one of the logistics platforms on a global scale with the digital technologies they have put into use, Tırport Board Member Responsible for Marketing Burcu Kale explained that they manage location-based and real-time logistics operations with end-to-end digital transformation. Explaining that they launched Tırport Insights as a logistics information service at the beginning of this year, Burcu Kale noted that live and up-to-date data, reports, analyzes and predictions about the sector are published on this platform.

Tırport Board Member Responsible for Marketing Burcu Kale said, “According to Tırport’s end-of-year data, only 1/3 of the approximately 450 thousand FTL shipments carried out in one day in our country consists of contracted shipments. Daily transportation of nearly 300 thousand trucks takes place entirely in the spot market, and since there is no contracted logistics, logistics companies cannot get a share of this cake. The vast majority of these transports are in closed loops within certain regions. It takes place on short lines such as Aliağa-İzmir, Gebze-Derince, Sakarya-Derince, İnegöl-Bursa, Merzifon-Samsun, Tarsus-Mersin. The loaders are mostly manufacturers in the SME category. Half of the cargo that comes out of the spot comes from 326 organized industrial zones, ports and warehouses.

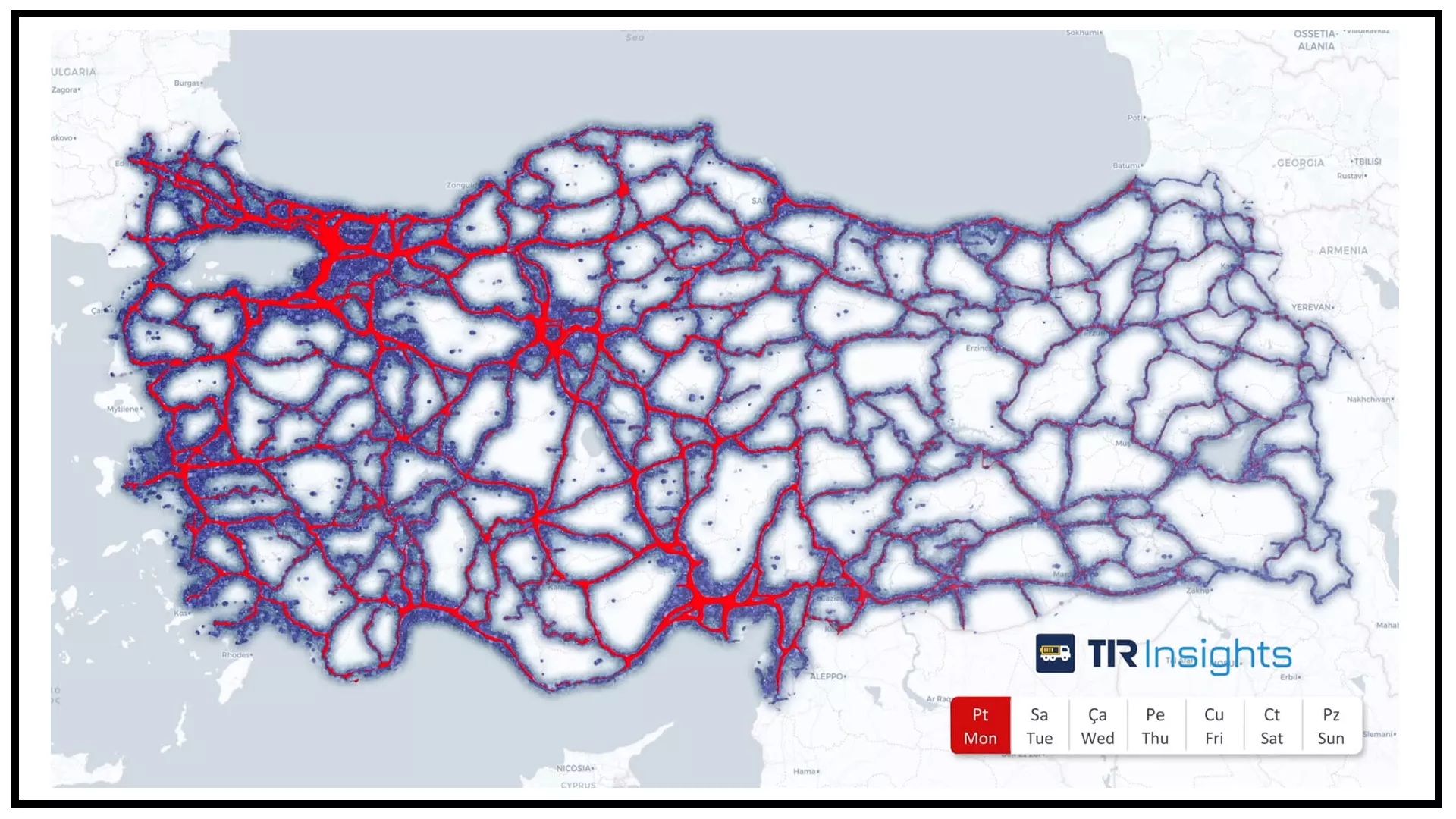

Kale continued as follows: “The heaviest road freight traffic between provinces in our country is between Kocaeli-Istanbul. It is followed by Istanbul-Ankara, Bursa-Kocaeli, Ankara-Adana, Bursa-Istanbul, Istanbul-Izmir, Mersin-Adana, Antalya-Mersin, Antalya-Istanbul, Canakkale-Balikesir, Konya-Ankara, Konya-Adana, Samsun-Trabzon, It follows the Çorum-Samsun, Adana-Gaziantep axis. Again, the heaviest truck traffic in our country is between Gebze-Kocaeli and this line is followed by Gebze-Istanbul, Adana-Mersin, Tarsus-Adana, Ankara-Polatlı, Nilüfer-Gemlik, Bursa-Balıkesir, Çorlu-İstanbul, Çumra-Konya lines. it does. The heaviest road transport traffic in Turkey takes place on the first days of the week. Freight traffic gradually decreases towards the end of the week and drops to 30% of the total volume on Sunday.”

Stating that the average waiting time for trucks to unload is about 11 hours, Kale said: “The average waiting time for unloading is 13 hours as well. These waiting times are still very high, and 64 percent of the calls made by truckers to Tırport’s smart call center are related to waiting times during the unloading and unloading processes. With the widespread use of smart loading-unloading appointment systems developed by Tırport, these times will be significantly reduced in the coming days. The average number of trips per month for a truck user of Tirport is 7.7. It travels an average of 344 km with a load per trip. While the rate of empty return of trucks in our country is about 37%, this rate remains at the level of 24% for trucks with Tırport. According to another data, while a truck waits 2.5 days to find a new load in our country, this rate is maximum 1.5 days for truckers from Tırport.”

Noting that 1/3 of the trucks are running empty on the domestic roads in 2020, Kale said, “82 percent of our trucks going to Europe are empty, and the highest rate of return is from Iraq with 90 percent. Depending on the economic conditions, the self-owned ratios of logistics companies are decreasing rapidly. 95 percent of the 858 thousand trucks on the roads in Turkey belong to individuals. This is a serious rate and no country in the world has such a high truck ownership rate. There are also large-volume logistics companies that do not have a single self-owned truck, although they carry over 2 thousand FTL transports per day. In short, in our country, where there are around 8 thousand large and small logistics and transportation companies, the total market share of the 5 largest companies in the market is not 2 percent. The average age of trucks in Turkey is 16 years old. It is stated that almost 70 percent of the truck fleets are in the 0-5 age range in countries such as Germany and England, to which we export the most. The truck fleet in Turkey is quite old when compared to Europe. Our country exports 50.5% of its total exports to the European Union and the United Kingdom, and it is predicted that the increasing age of trucks in the coming years may pose a problem in entering Europe.